Introduction

- For the purposes of this helpsheet the term ‘data’ includes documents in whatever form (including electronic) and other information. While this guidance relates to HMRC requests, other government bodies or organisations may also approach the member for data. The same principles apply.

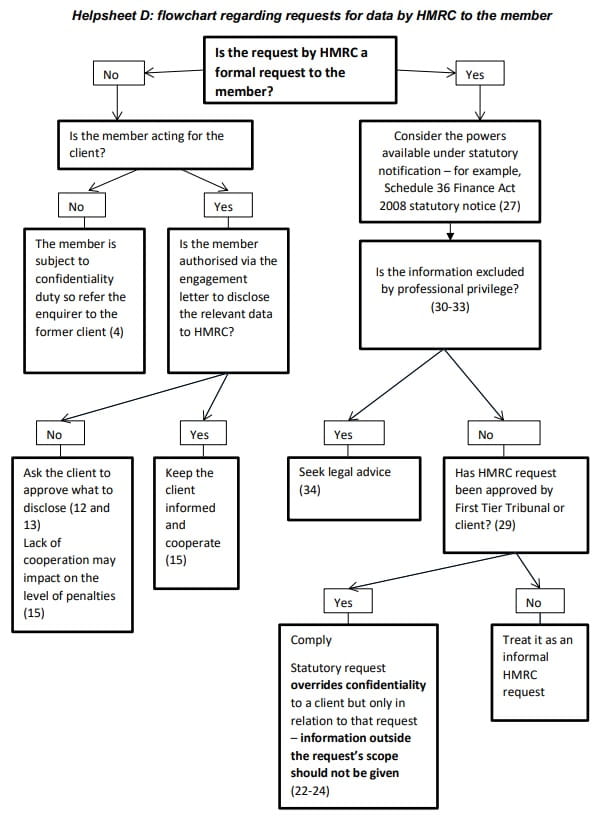

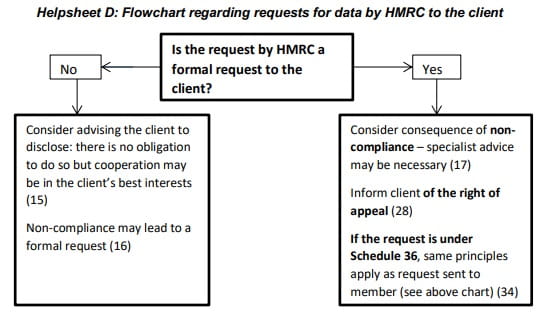

- A distinction should be drawn between a request for data made informally (‘informal requests’) and those requests for data which are made in exercise of a power to require the provision of the data requested (‘formal requests’).

- Similarly, requests addressed to a client and those addressed to a member require different handling.

- Where a member no longer acts for a client, the member remains subject to the duty of confidentiality. In relation to informal requests, the member should refer the enquirer either to the former client or if authorised by the client to the new agent. In relation to formal requests addressed to the member, the termination of their professional relationship with the client does not affect the member’s duty to comply with that request, where legally required to do so.

- A member should comply with formal requests and should not seek to frustrate legitimate requests for information. Adopting a constructive approach may help to resolve issues promptly and minimise costs to all parties.

- Whilst a member should be aware of HMRC’s powers it may be appropriate to take specialist advice.

- Devolved tax authorities have separate powers.

- Two flowcharts are at the end of this helpsheet;

- Requests for data addressed to the member, and

- Requests for data addressed to the client.

Informal requests addressed to the client

- From time to time HMRC chooses to communicate directly with clients rather than with the appointed agent.

- HMRC has given reassurances that it is working to ensure that initial contact on compliance checks will normally be via the agent and only if the agent does not reply within an appropriate timescale will the contact be directly with the client.

- When the member assists a client in dealing with such requests from HMRC, the member should advise the client that cooperation with informal requests can provide greater opportunities for the taxpayer to find a pragmatic way to work through the issue at hand with HMRC.

Informal requests addressed to the member

- Disclosure in response to informal requests can only be made with the client’s permission.

- In many instances, the client will have authorised routine disclosure of relevant data, for example, through the engagement letter. However, if there is any doubt about whether the client has authorised disclosure, the member should ask the client to approve what is to be disclosed.

- Where an oral enquiry is made by HMRC, a member should consider asking for it to be put in writing so that a response may be agreed with the client.

- Although there is no obligation to comply with an informal request in whole or in part, a member should advise the client whether it is in the client’s best interests to disclose such data, as lack of cooperation may have a direct impact on penalty negotiations post—enquiry.

- Informal requests may be forerunners to formal requests compelling the disclosure of data. Consequently, it may be sensible to comply with such requests.

Formal requests addressed to the client

- In advising their client a member should consider whether specialist advice may be needed, for example on such issues as whether the notice has been issued in accordance with the relevant tax legislation and whether the data request is valid.

- The member should also advise the client about any relevant right of appeal against the formal request if appropriate and of the consequences of a failure to comply.

- If the notice is legally effective the client is legally obliged to comply with the request.

- The most common statutory notice issued to clients and third parties by HMRC is under Schedule 36 FA 2008 and the suggested actions are described below.

Formal requests addressed to the member

- The same principles apply to formal requests to the member as formal requests to clients.

- If a formal request is valid it overrides the member’s duty of confidentiality to their client. The member is therefore obliged to comply with the request. Failure to comply with their legal obligations can expose the member to civil or criminal penalties.

- In cases where the member is not legally precluded by the terms of the notice from communicating with the client, the member should advise the client of the notice and keep the client informed of progress and developments.

- The member should ensure that in complying with any notice they do not provide information or data outside the scope of the notice.

- If a member is faced with a situation in which HMRC is seeking to enforce disclosure by the removal of data, or seeking entrance to inspect business premises occupied by a member in their capacity as an adviser, the member should consider seeking immediate professional advice, to ensure that this is the legally correct course of action.

Schedule 36 Finance Act 2008 statutory notices

- The most common statutory notice issued to clients and third parties by HMRC is under Schedule 36 FA 2008. The following notes relate only to civil enquiries; in any situation where the member knows or suspects that HMRC is undertaking a criminal investigation, specialist assistance should be sought.

- Schedule 36 FA 2008 allows HMRC to require a taxpayer and/or a third party to provide data reasonably required to check the taxpayer’s tax position within a specified time. HMRC can also inspect business premises and remove and/or copy data.

- A member should be familiar with the rules relating to HMRC’s powers to issue a Schedule 36 notice and the relevant rights of appeal and should advise only where experienced to do so. Where appropriate, experienced tax investigation assistance should be obtained.

- The provisions of Schedule 36 are themselves complex and outside the scope of this guidance. The following points in relation to a member’s conduct should be noted:

- HMRC can only issue a notice to a third party where it is approved by the First-Tier Tribunal or where the taxpayer to whom the notice relates agrees.

- HMRC may agree to extend any deadline for submission of the data depending on the circumstances. Any request for more time should be made well in advance of the deadline where possible.

- Schedule 36 does not allow HMRC to force entry to premises and the client can refuse HMRC entry, however this should be done only where the client has good reasons. In any such case the member should recommend that the client seeks specialist advice.

- A Schedule 36 notice does not override legal professional privilege. A member needs to be aware of this and take specialist advice where appropriate in such cases.

Privileged data

- Legal privilege arises under common law and may only be overridden if this is set out in legislation. It protects a party's right to communicate in confidence with a legal adviser. The privilege belongs to the client and not to the member.

- If a document is privileged: The client cannot be required to make disclosure of that document to HMRC. Another party cannot disclose it (including the member), without the client's express permission.

- There are two types of legal privilege under common law: legal advice privilege and litigation privilege.

(a) Legal advice privilege

Covers documents passing between a client and their legal adviser prepared for the purposes of obtaining or giving legal advice. However, communications from a tax adviser who is not a practising lawyer will not attract legal advice privilege even if such individuals are giving advice on legal matters such as tax law.

(b) Litigation privilege

Covers data created for the dominant purpose of litigation. Litigation privilege may arise where litigation has not begun, but is merely contemplated and may apply to data prepared by non-lawyer advisers (including tax advisers). There are two important limits on litigation privilege. First, it does not arise in respect of non-adversarial proceedings. Second, the documents must be produced for the ‘dominant purpose’ of litigation.

- A privilege under Schedule 36 paragraphs 19, (documents relating to the conduct of a pending appeal), 24 and 25 (auditors, and tax advisers’ documents) might exist by “quasi-privilege” and if this is the case a tax adviser does not have to provide those documents. Care should be taken as not all data may be privileged.

- A member who receives a request for data, some of which the member believes may be subject to privilege or ’quasi-privilege’, should take independent legal advice on the position, unless expert in this area.

While every care has been taken in the preparation of this guidance the PCRT Bodies do not undertake a duty of care or otherwise for any loss or damage occasioned by reliance on this guidance. Practical guidance cannot and should not be taken to substitute appropriate legal advice.