HMRC may send a nudge letter or open an enquiry, and the taxpayer may have options for making a disclosure to HMRC. ICAEW’s Tax Faculty sets out the key points.

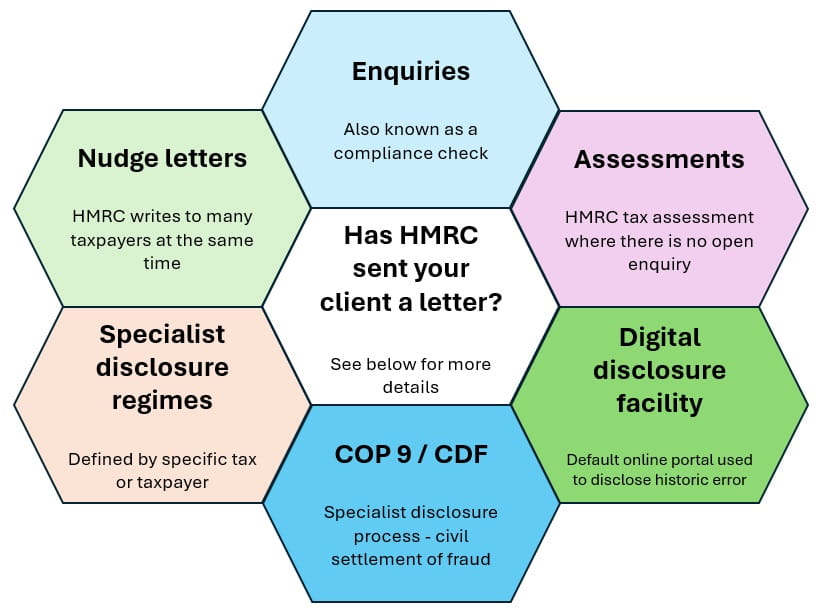

The main areas are set out in the diagram below. See the text below for more detailed guidance.

Nudge letters

Nudge letters are used by HMRC to write to multiple taxpayers about the same issue at the same time. They are not formal enquiries.

Broadly, nudge letters are either educational or data-based. They are mainly issued to taxpayers, but occasionally HMRC will write to agents about a group of their clients. There may be data security issues with this, and ICAEW has raised this with HMRC who should now contact the agent in advance to agree an appropriate format.

Sometimes a nudge letter will identify a need to make a disclosure to HMRC regarding a taxpayer’s affairs.

In all cases, we recommend discussing the nudge letter with your client. Sometimes a nudge letter will identify a need to make a disclosure to HMRC regarding a taxpayer’s affairs (see Professional Conduct in Relation to Taxation (PCRT)).

Where a disclosure is required, the client will need additional support on how to make this. Where necessary, a specialist in tax compliance and investigations matters should be consulted.

Educational nudge letters

These letters do not suggest that the taxpayer has made a mistake or ask them to take any action. Instead, educational nudges highlight common tax errors and changes to legislation, HMRC guidance and processes.

Data-based nudge letters

This type of nudge letter cites specific data (eg, data on offshore assets and income; entry on the Persons of Significant Control register) and invites the taxpayer to check their returns on this issue and notify HMRC if an error has been made.

There is currently a lack of clarity whether any disclosure made following this type of nudge letter is treated as prompted or unprompted. However, if an error with a tax impact of over £200 is identified because of a nudge letter, PCRT requires that this is notified to HMRC.

Some letters explicitly state that if HMRC does not receive a response, it will open a compliance check (enquiry) or take other actions to contact the taxpayer again. Therefore, although there is no requirement to sign the certificate attached to some nudge letters, it is important to guide your client through the necessary next steps. Where no errors have been made, this could involve emailing the relevant team in HMRC to confirm that to the best of your client’s knowledge there have been no errors in their return.

Enquiries

HMRC has the power to open enquiries (‘compliance check’) into a taxpayer’s return, usually within 12 months from the date of filing. If a return is filed late, HMRC has 12 months and to the end of the following quarter day to open the enquiry. The quarter days are 31 January, 30 April, 31 July and 31 October.

HMRC must issue an opening letter, which states the legislation under which the enquiry has been opened and the reason why the enquiry has been opened. If no legislation is quoted in the opening letter, this may be an ‘informal’ compliance check and not within the formal enquiry framework. This means there is no legal requirement to respond and HMRC cannot be compelled by the Tribunal to end their compliance check if it has been opened without a conclusion after several years.

The opening letter usually includes an information request, but this is not compulsory and can follow in the next round of correspondence.

If a return is amended, this extends the enquiry window in relation to the amendment – unless the amendment is so significant to the return, in which case the whole return is treated as having an extended enquiry window.

HMRC can only enquire once into an accounting period or tax year for the same taxpayer, so once an enquiry is closed that tax period is treated as final.

Enquiries are usually into either the full return or only an aspect of the return. If HMRC open a COP9 (‘suspected fraud’) enquiry or allege criminal behaviour, specialist tax investigations support must be engaged.

When the enquiry is complete, and the taxpayer and HMRC have agreed any additional tax, interest and penalties arising, HMRC will issue a closure notice.

If HMRC and the taxpayer/agent cannot agree, there are several options open to resolve the issue including independent statutory review, appeal to the Tax Tribunal and mediation (‘alternative dispute resolution’).

Assessments

An assessment is HMRC’s way of estimating the amount of tax or duties that might be outstanding because of, for example, an omission from a return. You can find more details of the taxes affected in HMRC’s Compliance Handbook.

The ‘normal’ time limit for raising an assessment is four years from the end of the relevant tax period. However, where tax has been lost as a result of the careless behaviour of the taxpayer or another person acting on their behalf, the time limit is extended to six years.

In the case of income tax, capital gains tax and inheritance tax, where the matter is an ‘offshore matter’, the time limit is extended to 12 years, regardless of whether reasonable care has been taken by the taxpayer.

Where tax has been lost as a result of the deliberate behaviour of the taxpayer or someone acting on their behalf, the time limit is extended to 20 years.

You should seek input from a compliance and investigations specialist if you are in any doubt over the time limit for an assessment to be raised.

The onus of proof is on HMRC to demonstrate that the taxpayer or another person has acted carelessly or deliberately. The standard of proof is the balance of probabilities. In other words, that it is more likely than not that the inaccuracy or the failure to comply with an obligation was made carelessly or deliberately.

If HMRC successfully raises an assessment of tax, the taxpayer may want to make or revoke claims to arrive at a better tax position. Such claims are known as ‘consequential claims’.

For income tax and capital gains tax purposes, a consequential claim can generally be made by the end of the year of assessment following the one in which the assessment was made.

Digital Disclosure Service

The Digital Disclosure Service (DDS) is the online portal for making a disclosure to HMRC to correct historic errors, where the return(s) can no longer be amended.

It does not include the option to attach documents, so for a more complex matter you may wish to also send a letter and accompanying tax calculations to HMRC. For more straightforward disclosures, this extra documentation may not be necessary.

The DDS can be used for two processes: registering for a disclosure, and making a disclosure. Both will involve having a government gateway ID and password.

Registering for a disclosure can be done either by the taxpayer directly or by the agent. Following registration, HMRC should issue a letter confirming that the case has been accepted for a disclosure and providing a payment reference number.

Making a disclosure involves re-entering the identification details from the registration, selecting the behaviour that led to the error, and then selecting which tax periods are impacted. The portal will then open further boxes to declare the tax, interest and penalty for each tax period and automatically generate a letter of offer to accept as part of the ‘submission’.

HMRC aims to respond to disclosures filed through the DDS within 90 days, but this may be longer in practice.

COP9 / Contractual Disclosure of Fraud

COP9 / the Contractual Disclosure of Fraud (‘CDF’) are names given to the same process where HMRC offers a chance to have a civil settlement rather than criminal prosecution of suspected tax fraud. The process can be initiated by either a taxpayer or by HMRC, although typically it begins with a letter from HMRC to an individual.

The taxpayer is invited to make a full and complete disclosure of all deliberate and non-deliberate errors affecting their personal tax position and any businesses in which they are involved. In return for this, HMRC will not pursue a criminal prosecution although this offer will be withdrawn by HMRC if the taxpayer lies or continues to commit fraud during the disclosure process.

If a COP9 letter is issued, the taxpayer has 60 days to either accept or decline HMRC’s offer of a civil process and to provide an outline disclosure. All material matters must be included in that outline disclosure, and therefore if COP9/CDF is issued specialist tax investigations support must be sought.

After the outline disclosure, there is typically an opening meeting between the taxpayer and HMRC followed by a scoping meeting between the taxpayer’s agent and HMRC to agree the terms of a full disclosure report.

The disclosure report will only comment on tax matters, but these matters may have wider implications (e.g. regulatory investigation, bribery and corruption charges, money laundering) and advice should be sought on these issues at the same time as the COP9 report is underway.

Once the report is complete, HMRC will review and test the report and then decide whether to accept it.

At the end of the process, the taxpayer is asked to sign a certificate of full disclosure and a statement of assets and liabilities. If either of these documents is incorrect, HMRC has the right to then launch a criminal investigation.

Specialist disclosure regimes

In addition to the DDS and the contractual disclosure facility (COP9), there are several specialist disclosure regimes relating to specific types of income and taxpayers. These include the Let Property campaign and the electronic sales suppression disclosure facility. HMRC also plans to introduce a disclosure facility relating to R&D tax relief claims. The purpose of these facilities is to enable fast track disclosures of omissions or errors outside the tax return amendment window on current hot topics for HMRC.

These disclosure facilities typically use a ‘g-form’ that taxpayers or their agents can complete online. Unlike COP9, these specialist facilities do not typically include an initial stage where the taxpayer gives notice that they will be making a disclosure. The information provided by the taxpayer though these disclosure facilities is also typically very specific and they do not offer immunity from criminal prosecution. You should always seek specialist tax investigations support if you are unsure which regime to use to disclose a tax irregularity.