The Monetary Policy Committee (MPC) met recently and voted to increase the Bank of England bank rate for the 12th consecutive time. With the bank rate now standing at 4.5%, a level not seen since October 2008, this article addresses the question, what is a fair level of interest which should be passed on to clients holding deposit funds with their law firm?

Although interest rates are rising, the big four high street banks are perceived to be reluctant to pass on savings rates to deposit holders. This includes client account products, which has led many firms to try and negotiate bespoke pricing with their banks.

The sporadic willingness of banks to offer their law firm customers a negotiated client account interest rate has undoubtedly led many law firm leaders to consider what is the appropriate level of interest to pass back to their clients (called a payment in lieu of interest earned).

Solicitors Regulation Authority (SRA) Accounts Rule 7.1 requires law firms to pay clients a fair rate of interest for any client monies held.

To consider what this means in practice it is important to understand how client monies are held with UK banks.

Current banking practices offers three methods of holding client monies

- Designated Client Accounts

- Undesignated Client Accounts (referred to as a General Client Account)

- Virtual Client Accounts

Designated Client Accounts

General Client Accounts

Virtual Client Accounts

The most popular way to hold client monies

Approach to client interest

Historically, rule 22.3 of the Solicitors Accounts Rules 2011, required firms to create a written interest policy which sought to provide a fair outcome for clients. The SRA’s own guidance at that time recognised that firms may hold funds within a pooled general client account and directed firms to pay clients the designated account rate. This is an extract from the SRA guidance:

“The Legal Services Act 2007 has abolished the distinction in the Solicitors Act 1974 between interest earned on client money held in a general client account or a separate 19/11/2014 Page 34 of 70 www.sra.org.uk designated client account, meaning that interest earned on the latter type of account is, in theory, to be accounted for like interest on any other client money on a "fair and reasonable" basis. In practice, however, a firm which wishes to retain any part of the interest earned on client money will need to hold that money in a general client account and continue to have interest paid to the office account (see rule 12.7(b)).”

In effect this meant the client would not lose out on any interest which could have been earned had funds been placed in a designated account in their own name.

What changed?

As a consequence of the crash of the UK banking system in 2008, the resultant economic fallout led the UK government to reduce interest rates, eventually to a historic low of 0.1%.

This situation meant many deposit accounts, including client accounts, paid very little or no interest on funds held. Therefore, interest calculations were unlikely to generate an amount in excess of the administration costs associated with managing client monies (referred to as the de-minimis level, it was standard practice for law firms in England & Wales to withhold any calculations below £20). In short, neither the firm nor client earned any interest.

Where are we today?

Today, still raw from the COVID-19 pandemic, the economy is hindered by high inflation, the government has increased interest rates to combat the effects of inflation, which may be bad news for borrowers but, for law firms holding client monies, the opportunity to earn greater return of funds has returned.

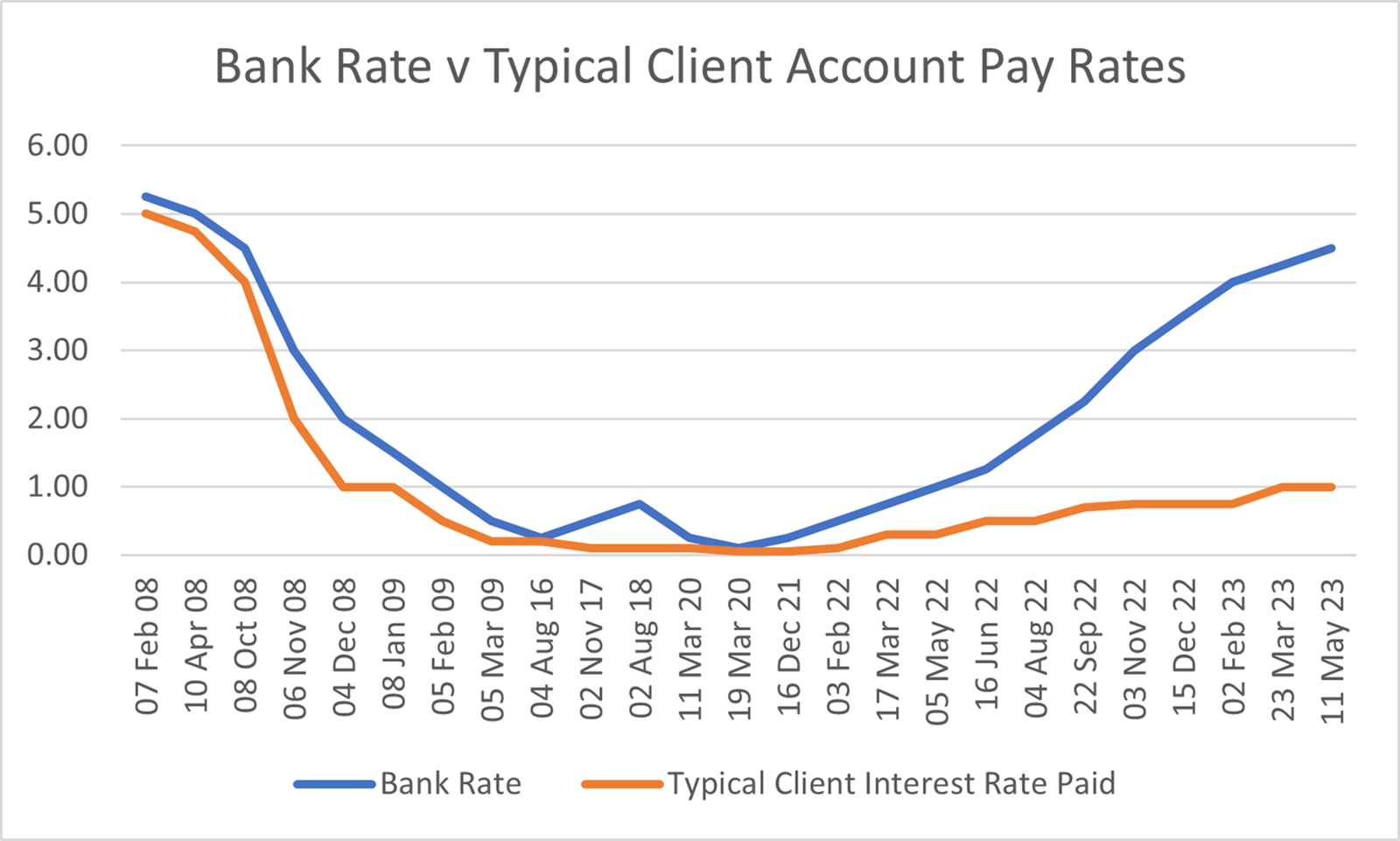

The problem this time is, although bank rates have recovered to levels seen in 2008, the rates paid on clients account remains far below the interest levels paid in 2008. This situation encourages law firms to follow SRA Account Rule 7.2 which permits the firm to make their own arrangements with clients thus creating the dilemma. What is a fair rate of interest to pay to clients?

“Ensuring clients are not disadvantaged is a key tenet of the SRA Account Rules. Simply put, law firms are expected to act in the best interest of each client.” (SRA Principle, Number 7)

What does a fair rate of interest mean?

Understanding what is considered fair and reasonable is the whole point of this article.

The Solicitors Act 1974 (S33(3)) makes clear that “Except as provided by the rules a solicitor is not liable to account to any client, other person or trust for interest received by the solicitor on money held at a bank or building society in an account which is for money received or held for, or on account of the solicitor's clients, other persons or trusts, generally.”

To be clear, law firms are not required or expected to scour the market for the best available interest rates. It is more important to hold client monies with a strong bank where the service levels support the day-to-day business function. That said, the uncertainty of what is considered fair usually leads to one of three behaviours:

Common examples

- Law firms with a blanket policy to pay clients no interest at all

- Law firms paying clients more interest than they themselves receive from the bank

- Law firms paying clients a specified rate which they themselves consider fair

You will have you own view on which of the above is reflective of what happens in your firm.

In my experience, gained over many years as a law firm banking specialist and laterally as a Law Society approved Lexcel Assessor, the approach taken is usually option 3. firms paying clients a specified rate which they themselves consider fair.

Fairness works both ways

Due to the fear of ‘getting it wrong’, we do see firms that have referenced the rates paid to the client to be the same as a personal account with the firm’s primary bank. As these bank accounts tend to pay more than the general client account, the firm is effectively paying more interest to the client than they themselves receive. This can be a costly decision and not one that could be considered fair to the firm.

In my opinion, the SRA’s previous guidance (prior to the banking crash) still seems the simplest and fairest way to achieve this. As a reminder, the SRA guidance was for law firms to match the rate paid to clients as per the advertised Designated Client Account Rate.

By taking this approach, the client will always receive the amount of interest they would have otherwise received had funds been placed in a Designated Client Account in the client's own name. To cover the basic cost of administration, the firm could specify a de-minimis level of £30, where no payment in lieu of interest is paid if the calculation is lower than this level.

Suggested wording for use in a client interest policy“The level of interest you can expect to receive, referred to as a payment in lieu of interest earned, will be based on the advertised interest rate(s) payable by our primary bank on the relevant amount, as if it had been held separately in a designated client account in your name. If the amount calculated is less than £30 then no interest will be paid as our administrative costs would exceed this amount. Interest rates can be located via the following link…”

De-risk Client Money Management

Another consideration which firms must consider, especially after the recent spate of banking failures in the US and mainland Europe, is the safety of client funds. In support of business continuity planning, law firm leaders should consider how they would cope with any interruption to their business caused by the failure of their bank or, perhaps more likely, the short-term outage of the bank’s online banking platform or worse a cyber fraud event on their client account.

Due to these risks, it is considered sensible to arrange a contingent banking facility where the law firm can apportion a specific level of funds held within the General Client Account to be held with a secondary banking provider.

By doing so, the firm can spread the risk of funds being held with a single banking provider. Whilst it is unlikely that a UK Bank will fail and trigger the requirement for clients to claim against the Financial Services Compensation Scheme (FSCS), a solid risk-based approach would be to apportion funds between two banks which enhances the FSCS coverage levels.

Help to develop your approach

To help law firms consider their approach to the handling of client monies, the Client Money Interest Scorecard, designed by Gemstone Legal, is a unique resource that helps law firms to assess any gaps in their current controls and offers an opportunity to confidentially discuss the best approach to manage client funds in future.

The scorecard takes less than three minutes to complete and does not require any financial information.

In conclusion

Determining a fair rate of interest to pay clients can be a challenge for law firms. The SRA Accounts Rules require law firms to account to clients for a fair sum of interest. Regardless of the preferred treatment of interest, it makes sense to create and communicate your approach, usually via a client interest policy, contained within the terms of business.

Paul will be speaking at the upcoming Solicitors Conference on 13 September, which you can book below:

Paul McCluskey is the Managing Director of Gemstone Legal, which helps firms to generate income from client monies whilst reducing risk. As an approved Lexcel assessor, Paul has worked with law firms across the UK to develop the most appropriate structures for client money which may provide an improved income for the firm and their clients. Prior to Gemstone Legal, Paul was UK head of Professional Practices, at Lloyds Bank and Bank of Scotland.