Q4: Sentiment drops into deep negative territory as challenges mount for businesses in the East of England.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

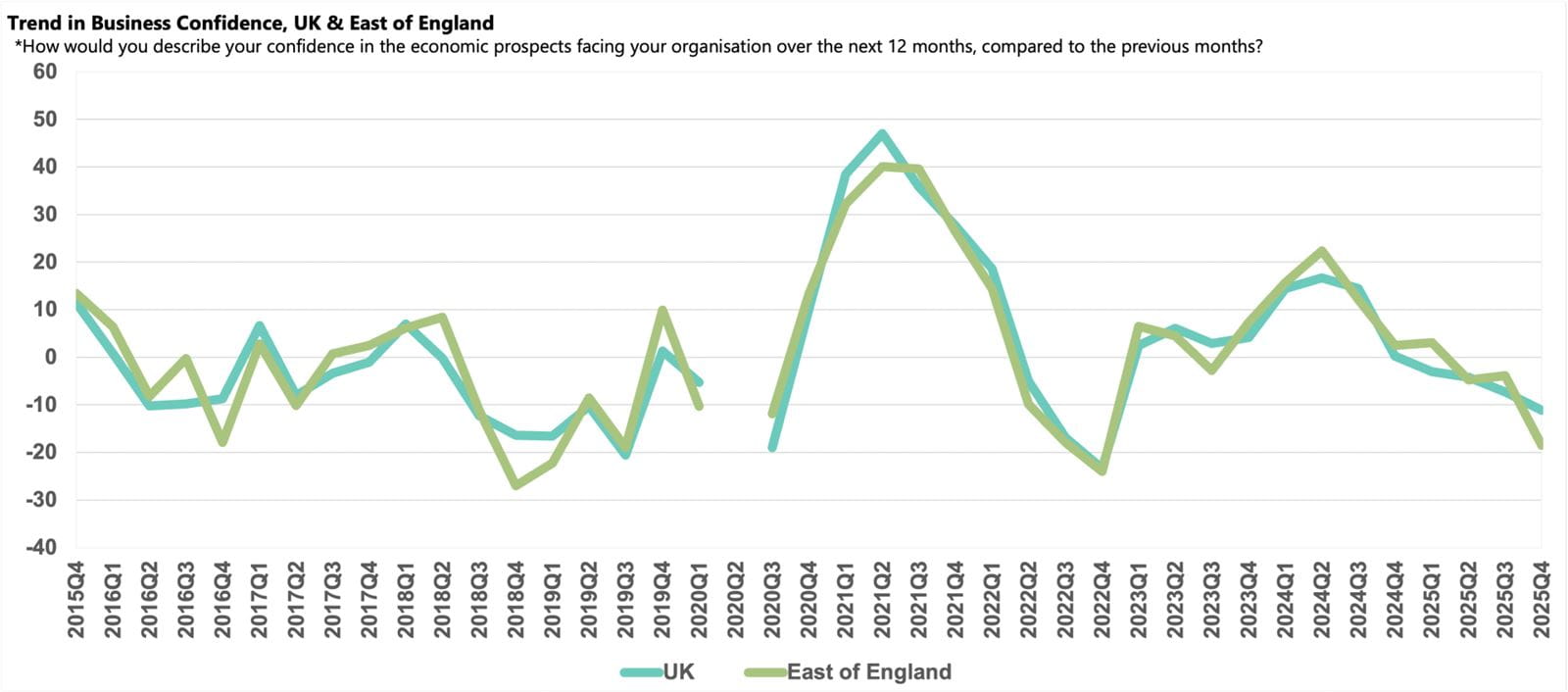

- The East of England Business Confidence Index dropped deeper into negative territory to -18.5, falling below the UK average (-11.1).

- There were marginal upticks in both domestic sales and exports growth in the year to Q4 2025, but both remain below their historical norms and the outlook is weaker than the national average.

- The tax burden is still the primary growing challenge in the region, followed by regulations and competition in the marketplace.

- Amid a spike in input prices, profits growth improved but remained below the historical average, however the outlook signals stronger gains ahead.

- Employment growth picked up slightly and businesses plan above average rises next year, but wage pressures are expected to mount.

- Capital investment growth was the weakest of any region and is set to remain below the UK average over the coming year, with R&D budget growth also expected to underperform.

Business confidence in East of England

Following a modest uptick in the previous quarter, sentiment in the East of England fell to a three-year low in Q4 2025. The Business Confidence Index dropped from -3.9 to -18.5, significantly below the region’s historical norm (+3.9). It means businesses in the region are now considerably less confident than the national average (-11.1).

The increased pessimism is linked to an uptick in a variety of challenges over the past year, which in turn have impacted sales performance. Like all other regions, businesses in the East of England have seen a spike in concern over the tax and regulatory burden, however, the proportion of businesses citing competition, late payments and difficulties in expanding into new areas has also risen sharply. As a result, both exports and domestic sales growth underperformed their long-run averages.

Domestic sales and exports growth

While companies in the East of England reported an uptick in annual domestic sales growth in Q4 2025 to 2.8%, it was below both the region’s historical norm (3.1%) and the national average (2.9%). Businesses project an uplift in growth over the coming year to 3.8%, also lower than the 4.2% anticipated across the UK. It is likely that the more pessimistic domestic sales outlook for the Transport & Storage, Construction and Property sectors is moderating the growth expectations for the region.

Businesses in the East of England also recorded an uplift in export sales growth, to 2.4%. Again, however, this is marginally weaker than the national average (2.5%) and slower than the region’s historical norm (3.0%). Companies anticipate there will be an uptick in exports growth in the year ahead to 3.2% but, again, this is lower than the rise expected nationally (4.1%).

Business challenges

Concern over tax has risen sharply since Q2 2024 and reached a survey record in Q4 2025, with 68% of East of England businesses reporting this burden, driven by higher labour costs after April’s rise in employers’ National Insurance and pre-Budget uncertainty. This proportion is nearly four times the regional norm (18%) and above the UK average (64%).

Regulatory pressures also intensified in Q4 2025, with 54% of businesses citing regulation as a growing challenge. This is the highest share since Q1 2019, likely linked to the Employment Rights Bill receiving Royal Assent in October.

Competitive pressure and weak demand are biting too. Nearly half (48%) reported competition in the marketplace as a growing challenge in Q4 2025, representing a 10-year high in concern and the highest proportion of any region. Meanwhile, 44% of businesses in the region cited customer demand, notably above the 39% historical norm.

Businesses are also struggling to expand into new areas, with almost one in five companies citing these concerns as a rising challenge in Q4 2025. At the same time, late payment from customers was a more prominent challenge in the East of England (27%) than in any other region, potentially signalling rising financial distress for some businesses in the region.

Labour market

Companies reported a marginal uplift in employment growth in Q4 2025, however the demand for labour in the region remains weak following April’s increase in National Insurance Contributions and the National Living Wage, with the 0.9% increase still below the regional historical average (1.3%). Looking ahead, businesses plan to raise the rate at which they grow their staffing levels to 1.6% over the next 12 months, stronger than the uplift anticipated in the previous quarter and above the national average projection of 1.3%.

Cooler labour demand over the past year has fed through to weaker salary inflation, which slowed to 2.3% in Q4 2025, equalling the region’s historical norm. This rise was among the softest increases in the UK, with only Scotland recording a smaller rise. Companies expect an uplift in wages growth over the coming year to 2.7%, broadly in line with the UK-wide projection (2.8%).

While reports of skills-related challenges remain significantly below their respective historical averages in the quarter, the issue of staff turnover was reported by 28% of businesses, which was above the region’s historical average (19%) and more prevalent than in any other region.

Input and selling prices, and profits growth

Annual input price inflation increased significantly in Q4 2025, rising to 4.6% and outpacing most other UK regions. While companies expect inflation will moderate considerably over the next 12 months, the anticipated growth of 3.3% is still higher than both the region’s historical norm (2.7%) and the 3.0% rise projected nationally.

Increased concern over competition in the marketplace and customer demand has likely limited companies’ ability to increase their selling prices. As a result, businesses in the region reduced the rate they raised their selling prices to 2.0% year-on-year in Q4 2025, despite the sharp uplift in input price inflation. While this rise is still above the region’s historical norm (1.4%), it is one of the softest rises recorded across the UK, lagging the national average increase of 2.3%. Businesses plan to lift their selling price growth over the next 12 months to 2.3%, marginally exceeding the 2.2% rise projected nationally.

With companies less able to raise their selling prices in response to cost pressures in the East of England, profits growth, while improved on the previous quarter at 2.8%, remained below the regional historical norm (3.0%). However, businesses in the region anticipate a significant improvement in profits growth to 4.0% over the next 12 months, though this expansion is lower than the national average projection (4.3%).

Investment

Capital investment growth in the East of England has been on a downward trend in recent quarters and, in Q4 2025, it recorded the weakest capital investment growth of any UK region, at just 0.5%. This rise was a quarter of the both the region’s historical norm and the national average (both 2.0%). Businesses plan to increase investment growth to 1.5% over the next 12 months, broadly comparable to the growth projected nationally (1.6%).

Meanwhile, companies in the region increased their R&D budgets by 1.3% in Q4 2025. While this was a marked uplift from the previous quarter, it was below the national average (1.6%). A further marginal uplift is anticipated over the coming year, however the projected expansion of 1.5% over the next 12 months is weaker than the regional norm (2.1%).