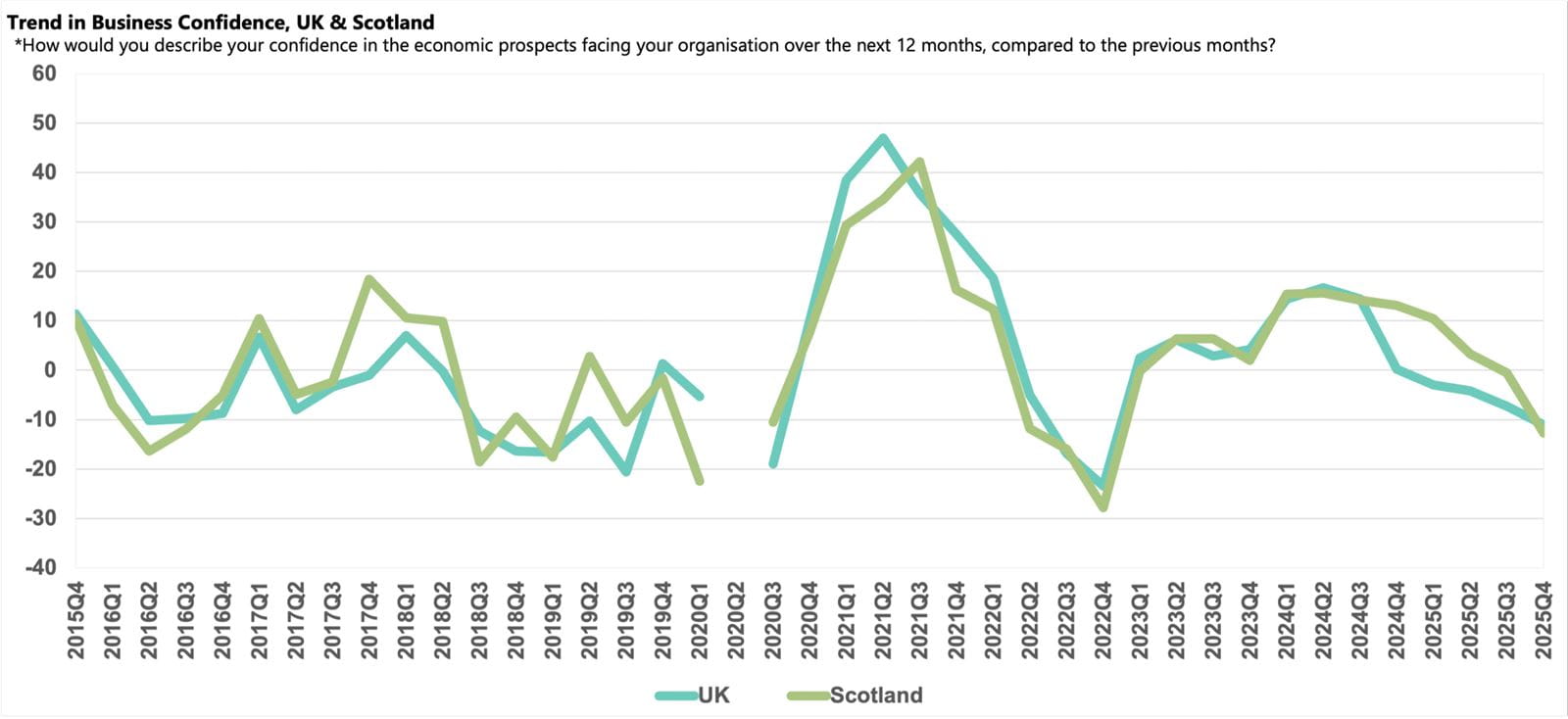

Q4: Scottish business confidence slips into deep negative territory and below the UK average

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- Sentiment in Scotland dropped to -12.7 in Q4 2025, the lowest score since Q4 2022, with companies more pessimistic than the UK average (-11.1).

- Confidence dipped amid pre-Budget uncertainty, sluggish domestic sales growth, faltering exports and below par profits growth. Prospects are expected to improve but the outlook is weaker than for the UK as a whole.

- The tax burden was the primary challenge for Scottish businesses, overtaking regulatory requirements.

- Inflationary pressures moderated and Scottish companies reported the weakest pay growth as employment declined, with further job losses expected.

- The investment outlook is mixed in Scotland, with the softest expected rise in capital investment of any UK region but stronger than UK average growth in R&D budgets.

Business confidence in Scotland

Sentiment in Scotland declined for the sixth consecutive quarter in Q4 2025 amid uncertainty about both the UK and Scottish Government Budgets and weak domestic and exports sales. Scotland’s Business Confidence Index dropped deeper into negative territory, falling from -0.5 in Q3 2025 to -12.7, down significantly from the region’s historical norm (+6.0) and marginally below the national average of -11.1.

Official data shows that the pace of economic growth in Scotland was likely flat in H2 2025, with GDP expanding by 0.2% in Q3 2025, while higher frequency monthly data shows the economy contracted by 0.2% in October. There was widespread uncertainty ahead of the November UK Budget, with the Scottish Government delivering its own Budget on 13 January which included a range of measures, including a cut in business rates. Political uncertainty may also be building ahead of the forthcoming Scottish elections in May. Indeed, perhaps reflecting this fact (and concerns about the forthcoming revaluation of non-domestic rates levied on premises), the proportion of Scottish businesses citing government support as a growing concern rose to the highest rate since Q1 2022.

Domestic sales and exports growth

Scottish businesses reported that annual domestic sales growth slowed significantly in Q4 2025, dropping below the region’s historical average (3.0%), to just 1.0%. This was the weakest of any UK region, lagging the 2.9% UK average. Flagging growth was likely linked to the slowdown observed in the locally important Manufacturing & Engineering sector. Despite an expected uplift over the coming year, the 2.8% projected rise is among the weakest forecast increases in the UK, only outpacing Wales (2.5%).

Annual exports growth ground to a halt in Scotland in Q4 2025, with only businesses in the North East reporting a weaker outturn with a 0.1% decline. US tariffs have likely played a part, particularly among Scotland’s whisky producers that are heavily reliant on US markets for their exports. Companies in Scotland expect exports growth will improve over the coming year, however, the expected rise of 1.8% is the weakest of any UK region, lagging both the region’s historical norm (2.9%) and less than half the projected UK increase of 4.1%. Again, the relatively pessimistic exports projection from Manufacturing & Engineering is likely a drag on the Scottish outlook.

Business challenges

Pre-Budget speculation and recent tax hikes, including increases in National Insurance Contributions, continued to weigh heavily on Scottish businesses as citations for the tax burden reached a new survey record high of 68% in Q4 2025. This issue was the most widespread concern for Scottish businesses, the proportion was over three times higher than the region’s historical average (19%) and more prevalent in Scotland compared to the UK average (64%). Regulatory worries continue to be one of the most widespread rising challenges for Scottish companies behind the tax burden, with 42% of businesses reporting regulatory requirements in Q4 2025, although marginally below the historical average of 44% and the UK average (51%). In addition, ahead of the forthcoming Scottish elections in May, the proportion of businesses citing government support as a growing challenge rose to 22%, over twice the historical norm (9%).

Customer demand (30%) and competition in the marketplace (37%) remain prominent issues for Scottish businesses but both were less prevalent compared to the national averages (41% and 38% respectively). However, concerns over financial related challenges, including late payments and access to capital, increased in Q4 2025 and were above the UK averages, with access to capital cited by 28% of Scottish businesses compared to 15% in the UK.

Labour market

Rising employment costs and weakening economic activity have dampened labour demand, with employment down 0.7% in the year to Q4 2025. This decline was Scotland’s weakest outturn since Q1 2021 and only businesses in Yorkshire & Humber recorded a larger decline (0.9%) over the year. Unlike most of the UK, businesses in Scotland expect further job losses over the next 12 months, with an expected drop of 0.4% which is the weakest projection of any region.

With the labour market cooling, annual wage inflation slowed to 2.1% in Q4 2025, dropping below the region’s historical average (2.2%) in Q4 2025, the weakest of any UK region. Scottish businesses expect wage growth to increase over the coming year but, at 2.7%, it is marginally below the national average projection of 2.8%.

Rising employment costs may also explain why Scottish businesses reduced staff development growth to just 0.3% in the year to Q4 2025, significantly below the region’s 1.3% historical average and their plan to cut staff development budgets by 0.5% in the year ahead. Scotland is the only part of the UK expecting a cut over the coming 12 months.

Input and selling prices, and profits growth

After an uptick in the previous quarter, annual input price inflation softened to 3.6% in Q4 2025, notably below the 4.1% growth recorded nationally and one of the softest rises in the UK. Businesses in Scotland expect input price inflation will moderate further over the coming year, dropping below the region’s historical norm (2.6%), to 2.1%, the weakest projection of any UK region.

Despite input price inflation softening in the year to Q4 2025, companies in Scotland increased the rate at which they raised their selling prices to 2.7%. The increase in prices charged to customers was above the national average of 2.3% and nearly double the historical average (1.5%). As cost pressures subside, significant moderation is anticipated and businesses in the region plan to increase prices by 1.8% next year, the weakest forecast of any region in the UK.

Weak domestic and export sales growth for Scottish businesses led to sluggish profits expansion of just 1.2% in the year to Q4 2025, lagging both the region’s historical norm (3.4%) and the national average (2.7%). Businesses expect profits growth will improve over the coming year, however the anticipated rise of 1.8% is less than half the UK average projection and among the weakest in the UK.

Investment

Scottish companies slowed capital expenditure growth in Q4 2025, with annual capital investment growth dropping below the region’s historical norm (2.1%), to 1.5%. Over the year ahead, businesses plan to reduce investment growth further and plan to increase capital expenditure by just 0.5% next year, the lowest projection in the UK at less than a third of the national average projection (1.6%). The outlook is likely linked to the locally important Energy, Water & Mining sector that plans a significant cut in investment growth.

Scottish businesses also expanded their R&D budgets by just 0.9% over the year to Q4 2025, well below the historical (2.0%) and UK (1.6%) averages. Companies expect to double this rate of growth next year, planning a 1.8% rise, which marginally exceeds the 1.3% expansion planned across the UK.